Over the top (OTT) is an online video service that allows people to receive movies, shows, music, and other digital content over the internet. Recently, Disney+, an OTT company, released a new series, "Moving”. “Moving” is a Korean drama with 20 episodes and a total production cost of 50 billion won. This is much more expensive than the blockbuster TV show Squid Game (28.5 billion won) in 2021. Although the drama "Moving" is gaining popularity, there is a crisis in domestic OTT.

The average production cost per episode for domestic dramas was only 100 million won in 2011, but it has gradually increased, reaching up to 1.2 billion won this year. With the advent of computer graphics (CG), it has become inevitable to invest huge amounts of money in order to succeed. The drama "Moving" is also analyzed to have produced high-quality works by significantly increasing production costs due to content competition caused by the expanding investment scale of global OTTs.

Netflix vs. The Rest

As the global predator Netflix continues to dominate, domestic OTT companies are in a chronic state of deficit. Compared to the cost of investing in content to compete, the revenue from subscribers is grossly insufficient.

According to IGAWorks Marketing Cloud, the number one MAU among domestic OTTs is Netflix, with 12.23 million users. It was followed by Coupang Play, TVING, and Wavve. There is a saying, "Netflix vs. The Rest," and Netflix dominates local OTTs in terms of original content production, investment, subscribers, and actual usage rate.

In the process of responding to original content competition, the scale of investment has ballooned and the deficit has widened. In addition, the switch from the pandemic that until now took charge of the progress of OTT platforms to the endemic has slowed down user growth, reducing profitability expectations and raising concerns about widening operating losses.

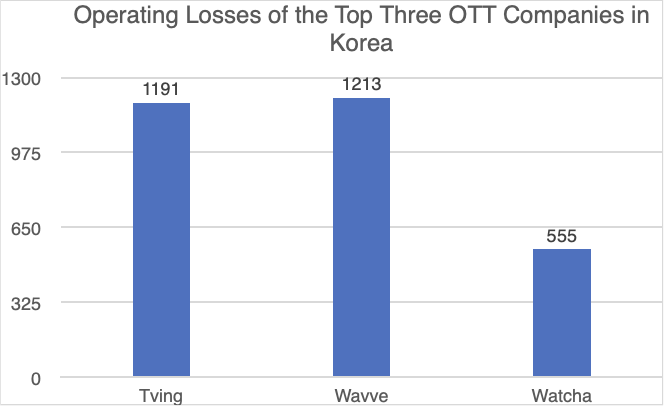

Domestic OTT companies such as TVING, Wavve, and Watcha posted huge losses last year. This is because they have been focusing on creating original content to compete with Netflix, but it hasn't paid off. Last year, the three companies representing Korea's indigenous OTTs (TVING, Wavve, and Watcha) combined for an annual operating loss of 296.4 billion won. Wave lost 112.3 billion won in operating losses last year, Tving lost 111.1 billion won, and Watcha lost 55.5 billion won. The main reason for the operating losses was the increase in original content production costs.

The “New Normal” for the Korean media industry

The “expansion of content investment” approach that has been used by indigenous OTT companies to date is expected to result in greater losses. Instead, it is time for the Korean media industry to consider the “New Normal”. A New Normal is an economic standard that emerges as times change, and in the case of the media industry, it means breaking away from the old ways of creating profit and pursuing new ones.

First, in this situation where content competition is poisonous, a vertical strategy that focuses on targeted production such as global and local can be used. In fact, Coupang Play, a domestic OTT company, provides OTT for free to subscribers of the paid subscription product “Wow Membership” at the shopping mall “Coupang”. In addition, the company has greatly enhanced its sports content by broadcasting European professional soccer team matches, clearly targeting specific audiences.

Second, fostering “Glocal” platforms can also be a way to revitalize domestic OTT companies. Glocal is a combination of global and local factors and refers to the strategy of fostering global platforms that can add local stories. By fostering platforms that have global distribution capabilities, rather than platforms that simply distribute and deliver domestic content, Korean companies should be able to protect their IP and make profits.

Park Sehyeon (2-7)¹ | Staff Reporter

1) pysyhy@naver.com

'Opinion' 카테고리의 다른 글

| The War of Semiconductors (0) | 2023.11.12 |

|---|---|

| "Whose land is Dokdo?", AI's Contradictory Answer (0) | 2023.11.12 |

| Media's TikTok challenge to interact with younger generations (0) | 2023.11.12 |

| Tokenism? Let's Consider Recent Issues Together with the Little Mermaid (0) | 2023.11.12 |

| Wait Right There, You Might Be Offending Someone! (0) | 2023.11.12 |